Disaster Insurance in the US: Ensuring Adequate Coverage for 2025

Disaster insurance in the US for 2025 requires a careful assessment of current policies, considering climate change impacts, regional vulnerabilities, and potential gaps in coverage, to ensure homeowners are adequately protected against unforeseen events.

Are you prepared for the unexpected? As we approach 2025, it’s crucial to assess your disaster insurance in the US: Are You Adequately Covered for 2025? to ensure you’re protected against potential natural calamities. Don’t leave your home and belongings vulnerable; let’s explore what you need to know.

Understanding the Rising Risks: A 2025 Perspective

The landscape of disaster insurance is constantly evolving, influenced by factors such as climate change and increasing urbanization. In 2025, understanding these rising risks is paramount to ensuring your coverage is adequate.

The Impact of Climate Change

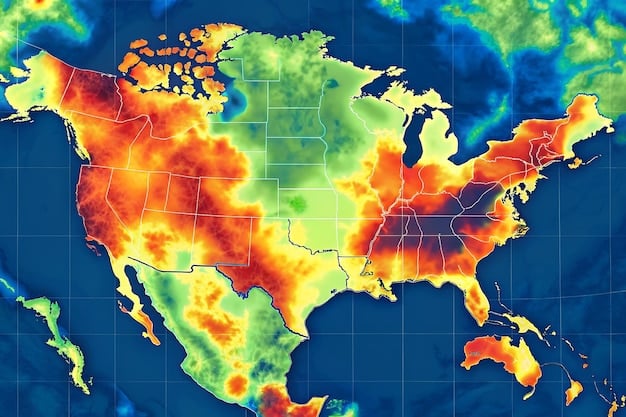

Climate change is no longer a distant threat; it’s a present reality. Rising sea levels, more frequent and intense storms, and prolonged droughts are just some of the effects that are reshaping the risk landscape.

Urbanization and Increased Vulnerability

As more people move into urban areas, particularly coastal regions, the potential for catastrophic damage increases. Densely populated areas are more vulnerable to widespread destruction from natural disasters.

Understanding the rising risks in 2025 means staying informed about climate change and urbanization trends. It also helps to reassess your insurance needs to ensure you’re adequately covered for potential disasters.

Decoding Disaster Insurance Policies: What’s Covered and What’s Not

Navigating the intricacies of disaster insurance policies can be daunting. Here’s a breakdown of what’s typically covered and what often requires additional coverage, helping you make informed decisions.

Standard Homeowners Insurance

Most homeowners insurance policies cover damages from events like fire, windstorms, and lightning. However, they often exclude floods, earthquakes, and other specific natural disasters.

Supplemental Coverage Options

To fill the gaps in standard policies, supplemental coverage options are available. These include flood insurance, earthquake insurance, and specific riders for events like mudslides or sinkholes.

- Flood Insurance: Essential for homeowners in flood-prone areas, often required by mortgage lenders.

- Earthquake Insurance: Provides coverage for damages caused by seismic activity, common in regions like California.

- Specific Riders: Tailored to cover specific events not included in standard policies, such as volcanic eruptions or landslides.

Understanding the nuances of your disaster insurance policy is crucial. Knowing what’s covered and what’s not allows you to make informed decisions about supplemental coverage.

Assessing Your Vulnerability: Identifying Your Specific Risks

Every region faces unique risks, from hurricanes along the coast to wildfires in the West. Assessing your vulnerability involves pinpointing your specific risks and understanding their potential impact.

Regional Disaster Risks

Different regions are prone to specific types of disasters. For example, the Atlantic coast is vulnerable to hurricanes, while the Midwest faces tornadoes and severe thunderstorms.

Property-Specific Risks

Your property’s location, construction, and landscaping can all affect its vulnerability. Homes near rivers or on hillsides have different risk profiles than those on flat land.

By identifying your specific risks, you can tailor your insurance coverage to address vulnerabilities effectively. This proactive approach ensures you’re adequately protected against the disasters most likely to affect your home and community.

Optimizing Your Coverage: Tips for Adequate Protection in 2025

Securing adequate disaster insurance involves more than just buying a policy; it requires careful planning and optimization. Here are some tips to help you protect your home and assets effectively in 2025.

Reviewing Your Policy Annually

As risks and property values change, it’s important to review your insurance policy annually. This ensures your coverage aligns with your current needs and that you’re not underinsured.

Increasing Coverage Limits

Consider increasing your coverage limits to reflect the true replacement cost of your home and belongings. This is especially important if you’ve made recent renovations or acquired new assets.

Understanding Deductibles

Adjusting your deductible can affect your premium costs. A higher deductible can lower your premium, but it also means you’ll pay more out-of-pocket in the event of a claim.

- Assess Replacement Costs: Ensure your coverage reflects current construction and material costs.

- Consider Policy Riders: Add specific riders for valuable items or unique risks.

- Work with a Trusted Agent: Seek professional advice to navigate complex insurance options.

Optimizing your coverage is an ongoing process that requires attention to detail and professional guidance. By taking a proactive approach, you can secure adequate protection and minimize potential financial losses in 2025.

The Role of Technology: Innovations in Disaster Insurance

Technology is revolutionizing the way disaster insurance is assessed, priced, and managed. From advanced modeling to drone inspections, innovations are enhancing the industry’s ability to respond to evolving risks.

Advanced Risk Modeling

Insurers are using sophisticated computer models to simulate potential disasters and assess their impact. These models incorporate climate data, geographic information, and historical trends to forecast risks more accurately.

Remote Sensing and Drones

Drones and satellite imagery are being used to assess property damage quickly and efficiently after a disaster. This technology allows insurers to expedite claims processing and provide timely assistance to policyholders.

AI and Claims Processing

Artificial intelligence (AI) is streamlining the claims process by automating tasks such as data entry, document review, and fraud detection. This reduces processing times and improves customer service.

The integration of technology into disaster insurance is transforming the industry. By leveraging these innovations, insurers can offer more accurate risk assessments, faster claims processing, and better overall service to policyholders.

Preparing Financially: Building a Disaster Readiness Fund

While insurance provides essential financial protection, building a disaster readiness fund can offer additional peace of mind. This fund can cover expenses not included in your policy and help you recover more quickly after a disaster.

Setting Savings Goals

Determine how much money you need to cover potential out-of-pocket expenses, such as deductibles, temporary housing, and essential supplies. Set a savings goal and make regular contributions to your disaster readiness fund.

Diversifying Your Assets

Consider diversifying your assets to reduce your financial vulnerability. This may include investing in low-risk securities, maintaining a savings account, and owning physical assets like precious metals.

Creating a Budget

Develop a budget that accounts for both insurance premiums and savings contributions. This ensures you’re allocating sufficient resources to protect yourself financially against potential disasters.

Building a disaster readiness fund complements your insurance coverage and provides a financial safety net in times of crisis. This proactive approach ensures you’re prepared to handle unexpected expenses and recover more quickly after a disaster, strengthening your overall financial resilience.

| Key Point | Brief Description |

|---|---|

| ⚠️ Assess Risks | Identify regional and property-specific disaster threats. |

| 🛡️ Policy Review | Annually check coverage and update as needed. |

| 💰 Readiness Fund | Build savings for expenses outside insurance coverage. |

| 🤖 Tech Integration | Leverage advancements in risk modeling and claims. |

FAQ

▼

A standard policy typically covers damages from fire, wind, and lightning. It doesn’t cover floods or earthquakes, which need separate coverage. Verify your policy details for specifics.

▼

Flood damage is often excluded from standard policies due to the high risk in certain areas. Flood insurance is essential for those in flood-prone regions and protects against water damage.

▼

Review your policy annually or after major life changes, like home improvements or new assets. This ensures your coverage matches your current needs and property value.

▼

A disaster readiness fund covers expenses not included in your insurance, such as deductibles or temporary housing. It provides financial backup during emergencies and enhances your recovery.

▼

Climate change increases the frequency and severity of natural disasters, leading to higher insurance premiums. Assessing climate-related risks helps homeowners find adequate coverage and protect assets.

Conclusion

As we look towards 2025, ensuring your disaster insurance in the US: Are You Adequately Covered for 2025? is not just a matter of compliance, but a critical step in protecting your home, family, and financial future. By understanding the rising risks, decoding your policy, assessing your vulnerabilities, optimizing your coverage, embracing technology, and preparing financially, you can face the future with confidence.